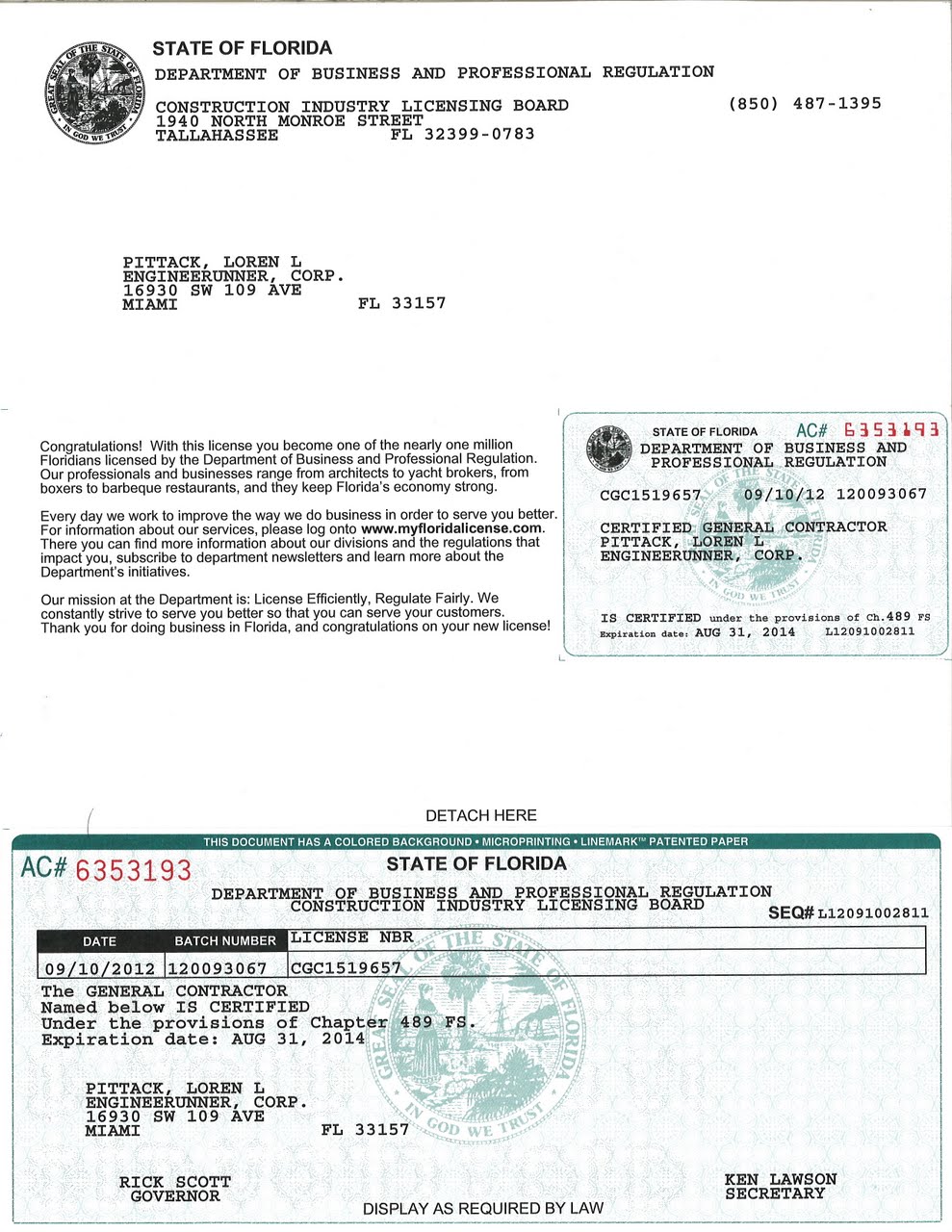

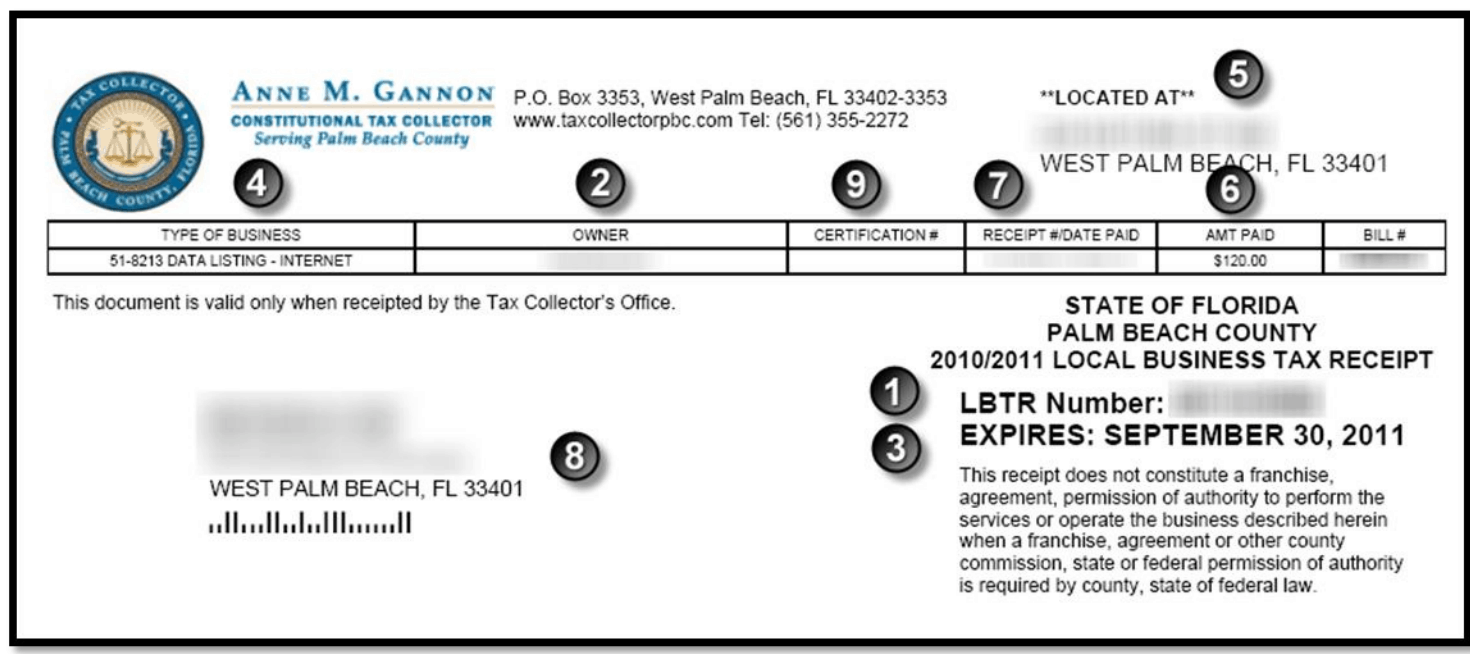

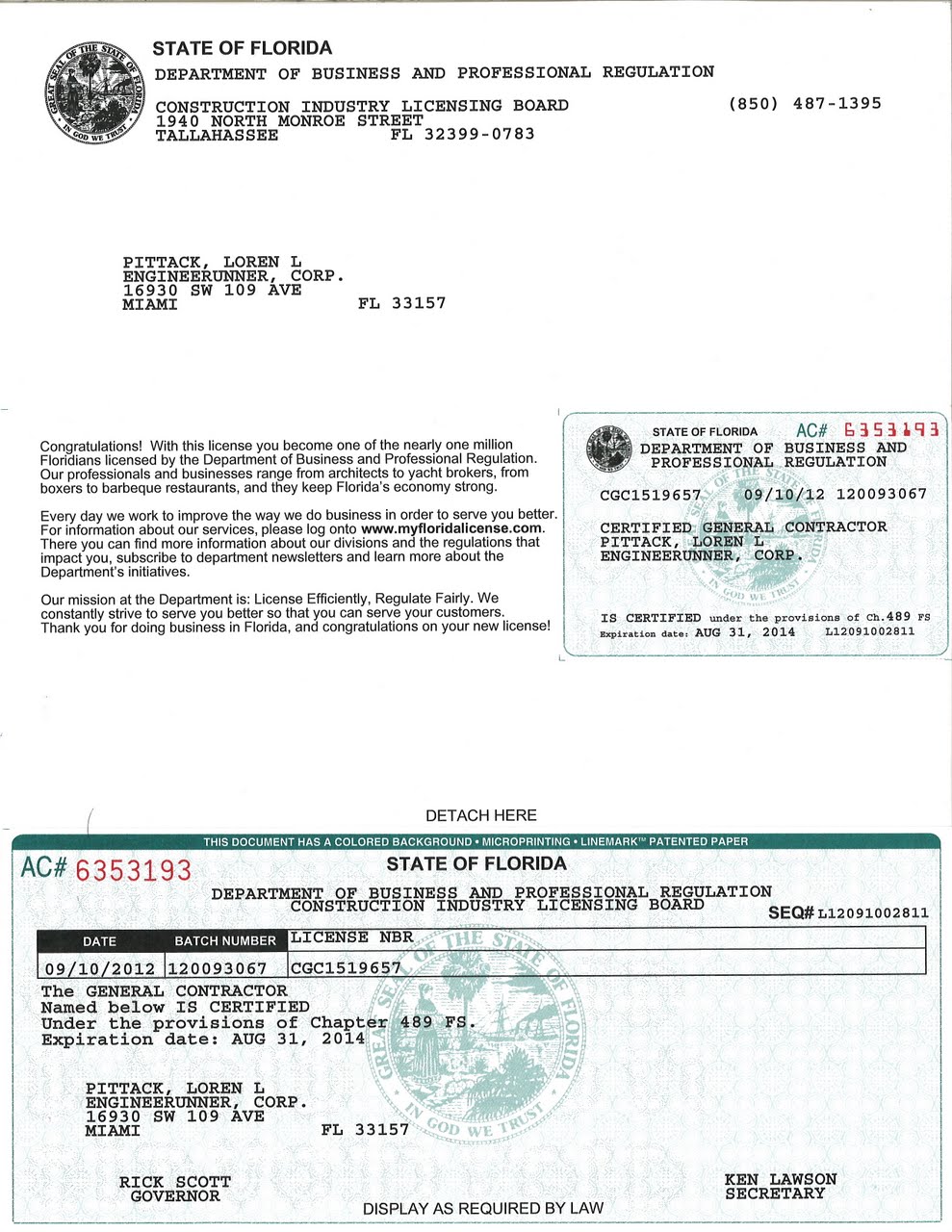

palm beach county business tax receipt phone number

The City of West Palm Beach Business Tax classifications and rate schedule can be found in Section 82-163 of our municode. Palm Beach County Tax Collector Attn.

West Park Area Broward County Local Business Tax Receipt 305 300 0364

Business Tax Department PO.

. Payment of the tax receipt does not certify or imply the. The fees increase proportionately to the number of employees a business has. We cannot process Business Tax Receipt Applications For Short Term Rentals in our service centers.

Get a short-term Business Tax Receipt BTR number. Requirements for a business located within a municipality contact the City. Your TDT account number from Step 1.

Location Ownership Legal Business Name Dba Name Applicant. Hours Monday - Friday 800 am -. Tourist Development Tax PO.

Palm Beach FL 33480. Business Owner Enter by Last Name First Name LBTR Number Local Business Tax Receipt Mailing Address. Business Tax Department PO.

561-712-6600 Boca Delray Glades. Florida has a very broad public records law. Our mission is to deliver the highest quality service and support to the Palm Beach business community with excellence integrity and efficiency.

Box 3353 West Palm Beach FL 33402-3353. The maximum fee is 23625 for a company or business with 51 or more employees. Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us.

And payment of 33 for each rental property to. Your TDT account number from Step 1. APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT __ NEW Business Tax Receipt __ CHANGETRANSFER Circle.

Box 3715 West Palm Beach FL 33402-3715. Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199. Contact the Tax Collectors at 561-233-355-2264 or.

50 South Military Trail Suite 201 West Palm Beach FL 33415 West Palm Beach Area. 360 South County Road. Village Hall 1050 Royal Palm Beach Blvd.

Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No. Flagler County Info Line 386 313-4111 Flagler County Sheriff 386 437-4116. Mail completed application to.

Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No. The information in this article isnt exhaustive but it should help you start your research on local laws. The information in this article isnt exhaustive but it should help you start your research on local laws.

Royal Palm Beach FL 33411. You need a business before you can ask the local government to let you start operating. Tax Planner Services Guide Annual Report to Our.

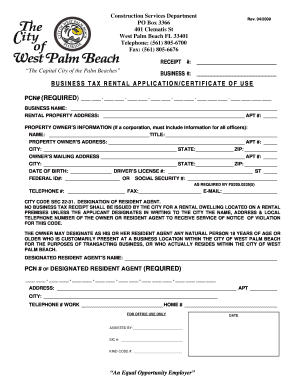

Tax Collector Palm Beach County Attn. Get a short-term Business Tax Receipt BTR number. Development Services Department 401 Clematis Street West Palm Beach Florida 33401 Phone.

Palm Beach County Tax Collector Attn. PO Box 2029. There may be other requirements in order to issue your business tax receipt.

561-841-3365 Select Option 1 Fax. 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us. Applying For a Palm Beach County Local Business Tax Receipt.

Completed Palm Beach County Business Tax Receipt Application Do not go to the county tax collectors office until have received Zoning approval from the Village of North Palm Beach. Information about onsite disposal and treatment systems including. Burkhart Today To Assist With All OF Your Local And County Tax Receipt Questions And Needs At 561 880-0155.

Town of Palm Beach. Office of the Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 305 295-5000. Local Business Tax Receipts.

Constitutional Tax Collector Serving Palm Beach County PO. Follow these steps to get a business tax receipt for your company. A business tax receipt is a tax levied upon all businesses within the municipal boundaries.

Allow 7 to 10 business days to process. West Palm Beach FL 33401 561 355-2264 Contact Us. Complete the Application for Local Business Tax Receipt.

Box 3715 West Palm Beach FL 33402-3715. Palm Beach Gardens FL 33410. If the use meets the Zoning Code requirements then the applicant will pay a fee schedule inspections receive the appropriate sign-offs from zoning code enforcement and fire rescue then submit the completed form to the Tax Collectors office who will then issue the Business Tax Receipt.

North Palm Beach FL 33408 Map Phone. Make sure to select Business Tax as your appointment type. Make an appointment at one of our service centers to process your completed application.

What the Tax Receipt Is. Information pertaining to Zoning Use Permits Brevard County Zoning 321-633-2070. Box 3353 West Palm Beach FL 33402-3353.

This requirement includes one-person and home-based businesses. Toll Free 888-852-7362 Fax. Any person selling merchandise or services in Palm Beach County must have a local business tax receipt.

Local Business Tax Constitutional Tax Collector

Local And County Tax Receipt Laws In Palm Beach County

City Of West Palm Beach Business Tax Fill Out And Sign Printable Pdf Template Signnow

Naples Florida Occupational License Application

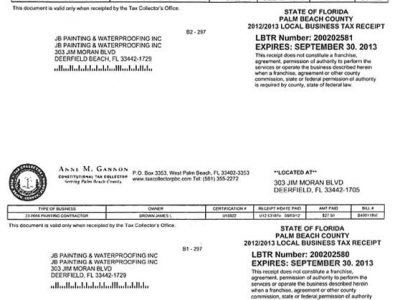

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

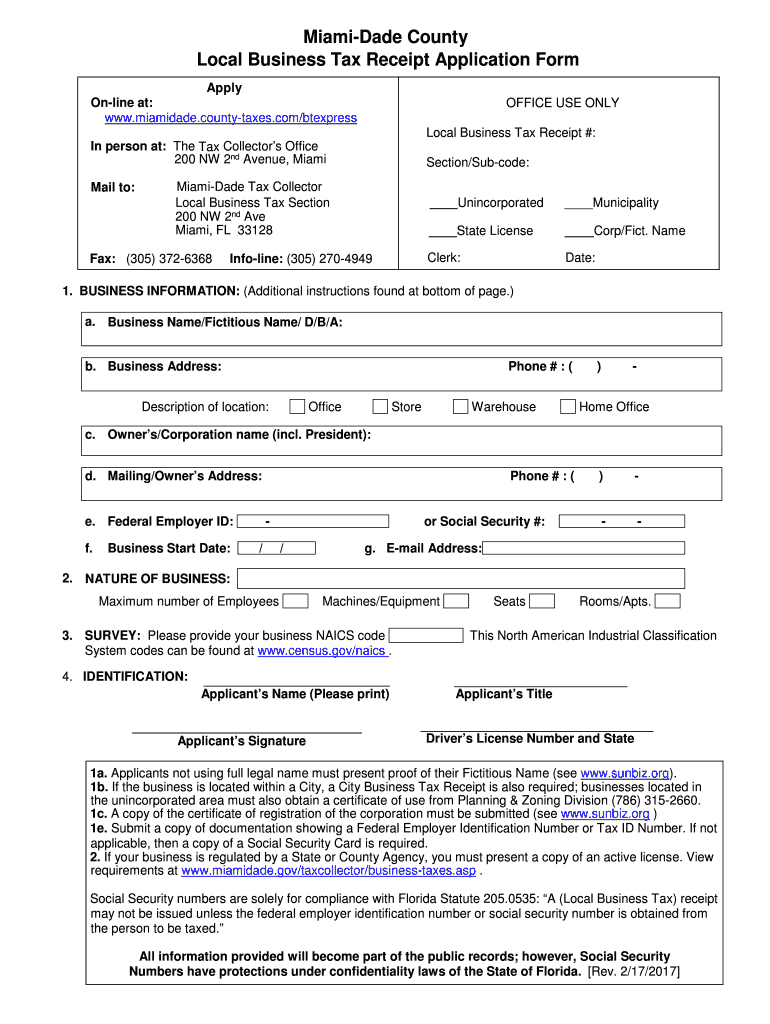

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

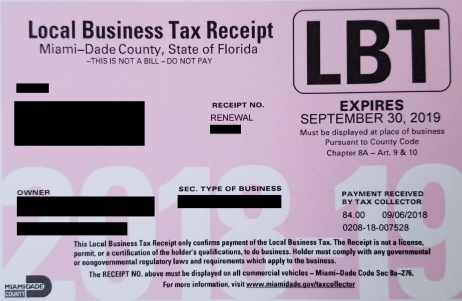

Miami Dade County Local Business Tax Receipt 305 300 0364

Tourist Development Tax Constitutional Tax Collector

Permit Source Information Blog

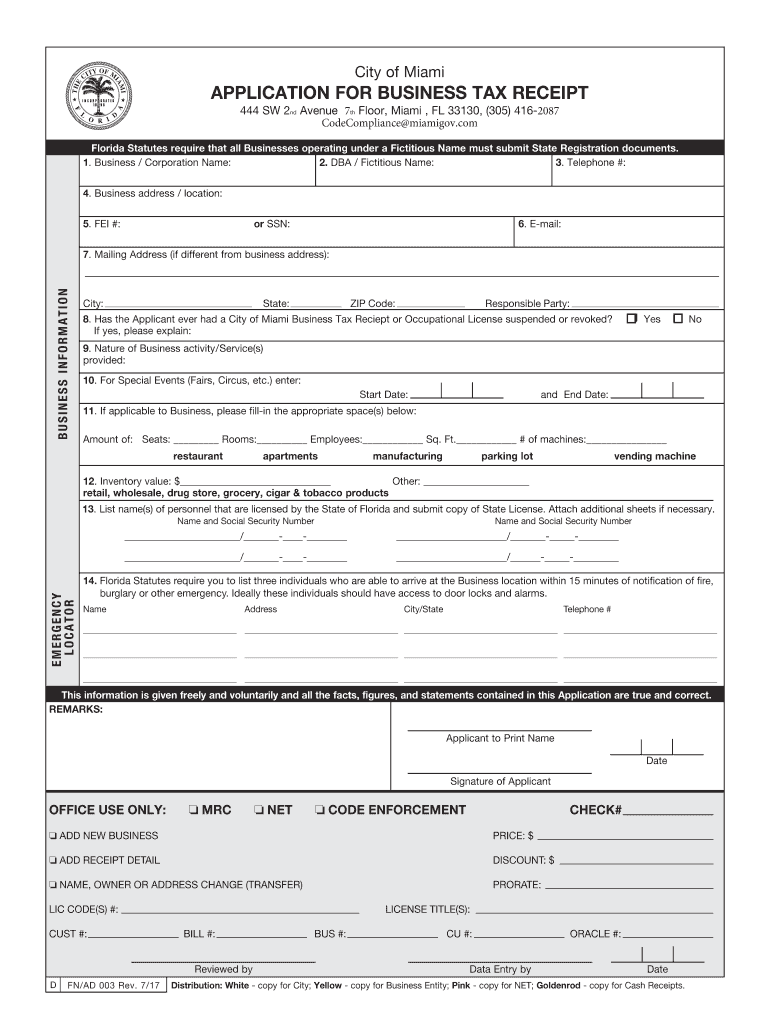

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Palm Beach County Local Business Tax Receipt 305 300 0364

Tile Contractor Licensed Insured Bonded Palm Beach To St Lucie County